Dina Sherman

Outgoing ASIFA-Hollywood executive director and Annies producer Frank Gladstone calls Sherman “a real spark plug. She’s been with us forever. I don’t see the Annies happening without her.”

A voice actor based in Los Angeles with a Broadcast Quality home studio.

Welcome to my official site – Please have a look around and do not hesitate to reach out!

Voice-over Grit, Delivers Your Daily Cream Of Wit

Dina Sherman, the Voice of the Annies, Reflects on 20 Years of Animated Awards

By Terry Flores

Dina Sherman is a busy voice actor working in animation, commercials, games and more but once a year she has a very special gig that gives her a unique perspective on the Annie Awards.…

Testimonials & Praise for Dina’s Voice-over Work

Animation

Anime, Dubbing,

& ADR

Commercials, Announcer, YouTube & More

Video

Games

Have a Unique Project?

Dina’s Blog Happenings

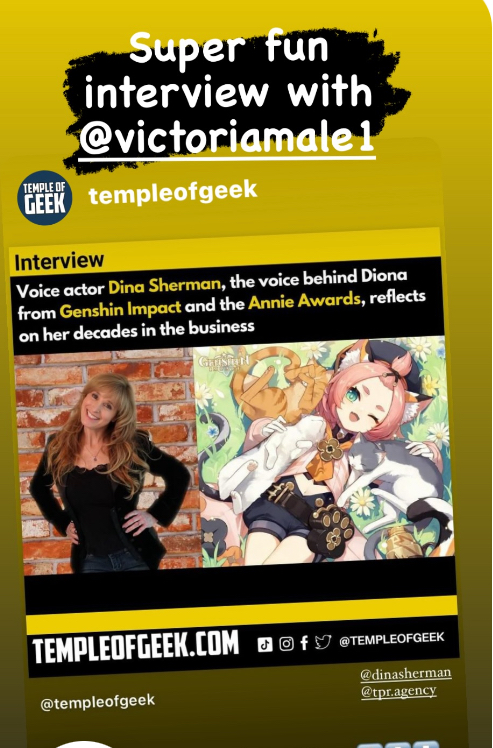

Temple of Geek Interview

Temple of Geek I sat down this week on zoom with the awesome and talented Victoria Male for a super […]

51st Annie Awards 2024

What an Awesome Annies Award show this year! My gosh what fun!!! After 19 years I thought I had seen […]

In Conversation with Amber ATF

In Conversation with ATF